An instrument is defined as any written document and in general- stamp duty is levied on legal commercial and financial instruments. The person liable to pay stamp duty is set out in the Third Schedule of Stamp Act 1949.

Malaysia Stock Calculator Apps On Google Play

The agreement stamp duty charges is around RM319 in total adding up other payable fees like SST legal fees and if you need extra copies which is around RM10 per copy.

. Malaysia Rental Stamp Duty Calculator For Example. Negotiable on the excess but shall not exceed 05 of such excess Stamp Duty for Sale and Purchase Agreements Transfers of Property. Tenancy Duration 2 Years The Tenancy Duration Falls into Category 2.

How Much you will need to Pay for Administration Fee. This calculator calculates the estimated or approximate fees needed for Stamp duty on Memorandum of Transfer MOT. RM2250-RM2250 RM000 Stamp Duty to pay.

Where the property price or the adjudicated value is in excess of RM7500000. Your Monthly Rental RM 1500. Stamp duty for instrument of transfer Stamp duty on loan agreement Total stamp duty to be paid.

The calculations done by this calculator is an estimation of Stamp Duty on MOT of house purchase in Malaysia it gives you an idea how. This consists of legal fees stamp duty and legal disbursement fees. This means that for a property at a purchase price of RM300000 the stamp duty will be RM5000.

If you would like to know how this figure came up you can read more about it here. Stamp duty for the transfer of ownership title also known as a memorandum of transfer or MOT Stamp duty Fee 1. Stamp duty on foreign currency loan agreements is generally capped at RM2000.

RM100001 To RM500000 RM6000 Total stamp duty must pay is RM700000 And because of the first-time house buyer stamp duty exemption you can apply for the stamp duty exemption. For First RM100000 RM1000 Stamp duty Fee 2. First RM100000 x 1 Next RM400000 x 2 05 of loan amount assuming 90 of property price RM450000 RM1000 RM8000 05 x RM450000 RM9000 RM2250.

The stamp duty fee for the first RM100000 will be 1000001 RM1000 The stamp duty fee for the remaining amount will be 300000-1000012 RM4000. Stamp duty Fee 3. Stamp duty Fee 4.

The Actual Calculation of Stamp Duty is before first-time house buyer stamp duty exemption. You will get a full summary after clicking Calculate button. Purchase Price or Adjudicated Value.

The Assessment and Collection of Stamp Duties is sanctioned by statutory law now described as the Stamp Act 1949. Manual Calculation Formulae as below or you can use the above Tenancy Agreement Stamp Duty Calculator Malaysia to help you calculate. Sale Purchase Agreement SPA.

The Actual Calculation of Stamp Duty is before first-time house buyer stamp duty exemption - RM450000 x 050 RM225000 After first-time house buyer stamp duty exemption. For the next RM2500000. Malaysian Ringgit RM loan agreements generally attract stamp duty at 05 However a reduced stamp duty liability of 01 is available for RM loan agreements or RM loan instruments without security and repayable on demand or in single bullet repayment.

Stamp duty Fee 2. Stamp Duty on MOT Stamp Duty Calculator Malaysia. Stamp duty Fee 1.

This also consists of legal fees stamp duty and legal disbursement fees. Transfer of ownership aka memorandum of transfer MOT. The following are the items you need to find out the cost of and are dependent on your property price.

Spa Stamp Duty Malaysia And Legal Fees For Property Purchase

Malaysia Legal Fees Cal Apps On Google Play

Peps Malaysia Stamp Duty Calculation Follow Peps Malaysia Facebook Page To Get Experts Insights On Property In Malaysia Stampdutymalaysia Pepsmalaysia Propertytaxmalaysia Facebook

Buying Property And Stamp Duty Planning Action Real Estate Valuers

Exemption For Stamp Duty 2020 Malaysia Housing Loan

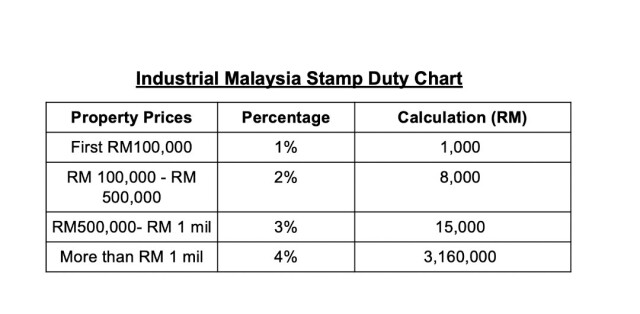

What You Must Know For Stamp Duty Tax And Exemptions When Buying Industrial Properties In Malaysia Industrial Malaysia

Spa Stamp Duty Malaysia And Legal Fees For Property Purchase

Buying A House Here S 2022 Stamp Duty Charges Other Costs Involved

Mot Calculation 2020 Property Paris Star

What Is A Trust Deed And Why Is It Important

Solved Question 4 Malaysia Tax A Mr James Purchased A Piece Of Land And Signed An Agreement For Its Purchase On 14 July 2016 At An Agreed Price Of Course Hero

Malaysia Real Estate Kuala Lumpur Property Legal Fees Stamp Duty Calculation When Buying A House In Malaysia

Malaysia Legal Fees Cal Apps On Google Play

Stamp Duty Legal Fees New Property Board

How To Calculate Legal Fees Stamp Duty For My Property Purchased

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Malaysia Property Stamp Duty Calculation Don T Know How To Count Property Stamp Duty Here Is It By Sheldon Property 74 Views 0 Likes 0 Loves 0 Comments 0 Shares Facebook